As we step into 2024, the Virginia Department of Taxation is rolling out significant changes that promise to reshape the way residents engage with their taxes. By simplifying the tax filing process and providing financial relief, these updates aim to make the often daunting task of tax season more manageable for Virginians. This guide will delve into key changes, compare Virginia’s tax systems with that of the Oregon Department of Revenue, provide essential resources, and much more.

Understanding these developments is crucial for residents hoping to maximize their benefits while minimizing errors and frustrations in their tax filing experiences.

1. Key Changes in Tax Laws by the Virginia Department of Taxation for 2024

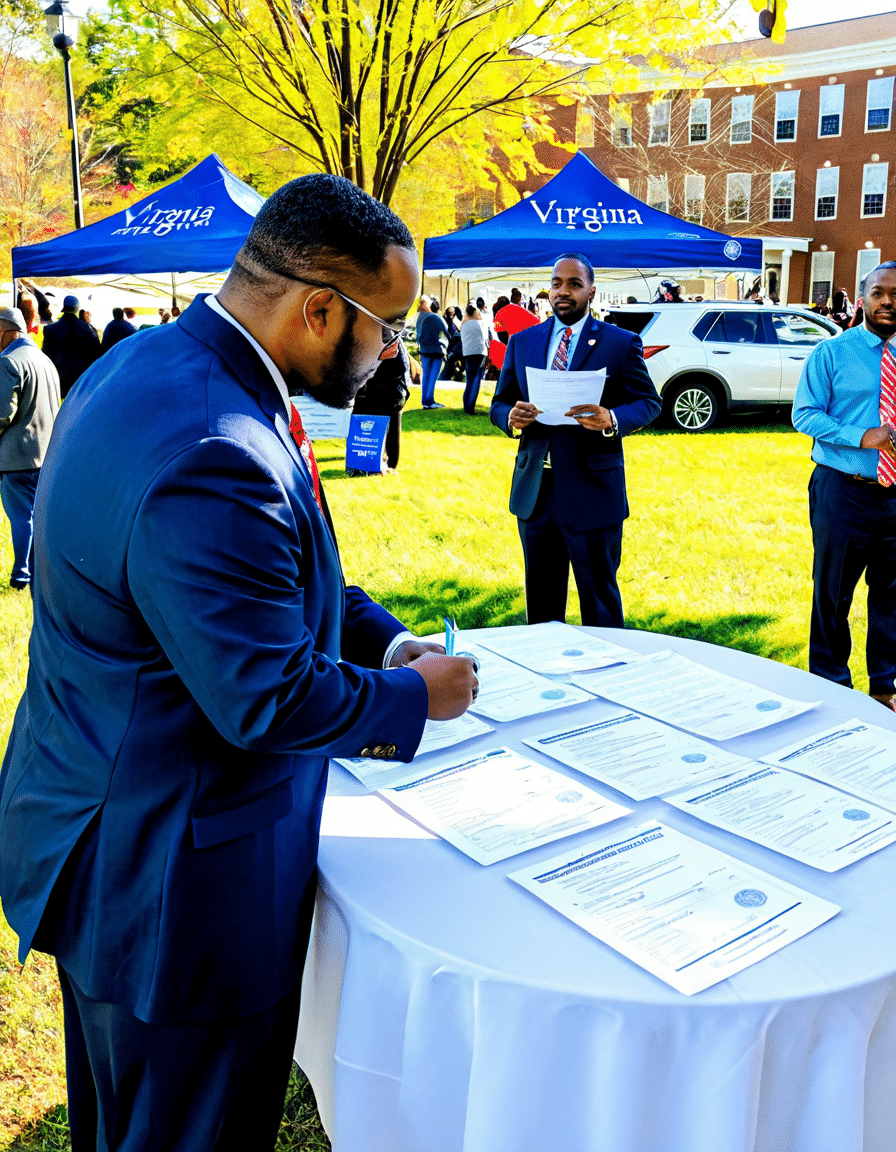

In 2024, the Virginia Department of Taxation has made it clear: tax season doesn’t have to be stressful. Among the most pivotal updates are alterations to deductions and credits designed to alleviate some pressures on taxpayers.

Major Changes

This array of changes signifies a commitment by the Virginia Department of Taxation to support citizens amid fluctuating economic conditions.

2. Comparing Virginia Department of Taxation with the Oregon Department of Revenue: A Study in Taxation Efficiency

While the Virginia Department of Taxation is working hard to improve taxpayer experiences, it’s insightful to see how it measures up against the Oregon Department of Revenue.

Key Points of Comparison

By examining these variances, Virginians can better appreciate the effectiveness of their local tax department and leverage available resources accordingly.

3. Essential Tax Forms and Resources from the Virginia Department of Taxation

Navigating through tax obligations can be tricky, but thanks to the Virginia Department of Taxation, an array of resources is readily available.

Must-Have Forms

With these critical forms and resources, residents can streamline their tax filing considerably.

4. Commencing Your Tax Filing: Step-by-Step Guidance

Getting started with your taxes can feel overwhelming, but breaking it down into manageable steps can ease the process.

Steps Include:

Thus, following these steps can lead to a more organized and less stressful tax experience.

5. Frequently Asked Questions about the Virginia Department of Taxation

Many taxpayers grapple with similar questions each year. Addressing these common inquiries can clear up confusion.

FAQs Include:

With the right knowledge and resources at your fingertips, you can tackle tax season with confidence.

6. The Future of Taxation in Virginia: Trends to Watch

Peering into the future, Virginia’s taxation landscape is poised for transformation. As legislation evolves, several trends will likely shape tax policies considerably.

Trends to Monitor

In summary, understanding the dynamics of the Virginia Department of Taxation, alongside its comparison with others like the Oregon Department of Revenue, assures taxpayers that there are resources and support systems available. By staying informed on changes, trends, and essential forms, individuals can navigate their tax obligations more efficiently. As developments continue, the commitment to improving taxpayer experiences will prove critical in making the tax-paying process more favorable for all Virginians.

Remember, as you face tax season head-on, taking proactive steps and leveraging available resources can make all the difference in maximizing your benefits and ensuring compliance.

Virginia Department of Taxation: Fun Trivia & Interesting Facts

A Peek into Virginia’s Taxing World

Did you know that the Virginia Department of Taxation manages more than just your everyday tax needs? This department plays a pivotal role in shaping the state’s economic landscape. For instance, Virginia offers various tax credits and deductions that can really make a difference for residents. Just like when you’re searching for the best rates For home Loans, understanding these tax benefits can lighten your financial load and help you keep more cash in your pocket!

Speaking of cash, did you hear about how state tax revenue funding has a hand in everything from education to infrastructure? It’s fascinating how closely linked fiscal policies are to aspects of daily life, much like how Bogdan Bogdanovic has made his mark in the world of basketball; both contribute to community enhancement in their own way. In fact, while managing your taxes, you’re unknowingly part of a larger network that supports essential services throughout Virginia.

Not Just Numbers: Tax Trivia That Entertains

Now, let’s dive into some quirky facts that make the Virginia Department of Taxation even more interesting! For instance, Virginia’s tax agency has gone digital, making it easier than ever to file your taxes online. This is a game changer for busy folks; just as many people have turned to American Airlines Wifi to stay connected while traveling, you can now file your taxes with a click! Virtual convenience is truly the name of the game these days.

And while we’re on the topic of connectivity, have you ever thought about how tax revenues help fund local development? It’s similar to how investments in sports can draw fans, like those eager to watch wrestling online or see local events. Through diligent tax contributions, citizens help ensure that their communities thrive, fostering a vibrant atmosphere that can entice new businesses and residents alike. So, while handling those tax forms may feel tedious, remember: you’re part of something bigger!

Keeping it Fun and Informative

To wrap it up, the Virginia Department of Taxation isn’t just a necessary service; it’s a cornerstone of communal support. Residents should feel empowered to explore the tax breaks available, just like you’d explore a new film featuring Sylvester Stallone’s wife or catch a thrilling ride in a new movie. Both experiences add flavor to life, and attending to your taxes can do the same for your financial health. So, whether you’re filing your returns or learning about Run Sweetheart run, just know you’re assisting your community along the way!

Remember, understanding the ins and outs of your local taxation can feel as confusing as figuring out How much Is meth based on various factors, but with the right information and resources, you can tackle it head-on. Just like every Shepshed corner has its charm, every tax benefit holds potential—so dig in and see what works for you!