The landscape of joe biden student loans in America has undergone significant changes, especially during the Biden administration. These alterations are reshaping the financial futures of millions, from current students to recent graduates. Understanding these changes is essential for borrowers who want to make informed decisions and take full advantage of the opportunities available.

Major Changes to Joe Biden Student Loans: Top 5 Impacts on Borrowers

Joe Biden’s administration has revamped the income-driven repayment (IDR) plans, making them more accessible. Now, payments are capped at 5% of disposable income, down from the previous 10%. This shift is meant to lessen the financial strain on low- to middle-income borrowers. With these new plans, many can pay off their loans more realistically and with a renewed sense of hope.

Under Biden, particularly following reforms from the Obama-Biden era, public service workers are seeing enhanced loan forgiveness options. Those employed in qualifying fields like education, health care, and non-profit organizations can now find paths to forgiveness tailored to their careers rather than just how many payments they’ve made. This streamlining means that many who’ve dedicated their lives to service may finally breathe easier with the prospect of relief.

Another significant change is the temporary freeze on interest accrual for federal student loans. This freeze allows over 43 million borrowers to experience a financial breather as they adjust to new policies. This pause could add up to savings of billions of dollars across the board. Many are grateful for this reprieve, as it helps alleviate some economic burdens while navigating post-pandemic realities.

The push for two years of free community college is gaining momentum. Initiatives aimed at bolstering funding for these institutions intend to enhance how many students can access higher education. The ultimate goal here is to help reduce reliance on crippling student loans and make education a more attainable dream for all. This initiative not only addresses financial concerns but also contributes to long-term economic growth.

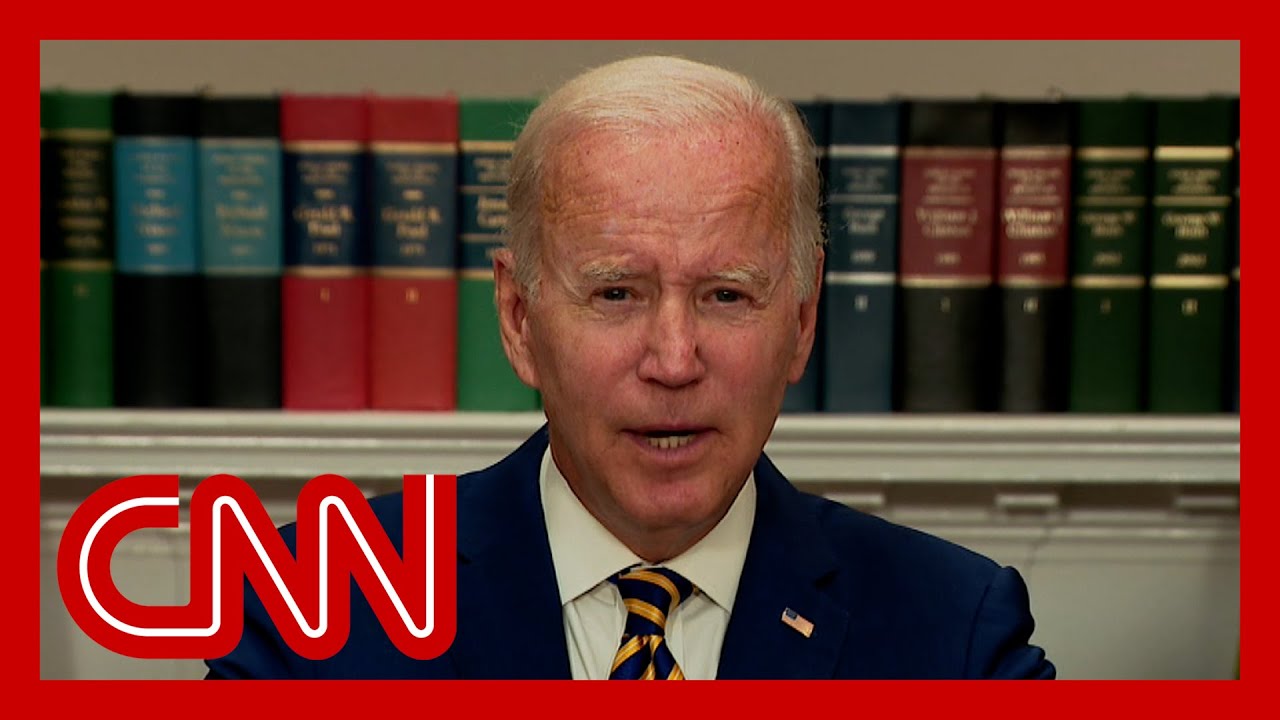

Recently, Joe Biden delivered a pivotal speech, underscoring upcoming changes and reaffirming his commitment to reforming the student loan system. He highlighted the importance of equitable education access and pledged to continue advocating for debt relief measures that have already made a significant difference for tens of thousands of borrowers. These announcements reflect an ongoing effort to adapt student loan policies to match our society’s evolving needs.

Examining Biden’s Approval Rating in Relation to Student Loan Policies

In the climate of these changes, Biden’s approval rating has had its ups and downs. Public perception about the administration often hinges on how well they handle issues surrounding student loans. While many borrowers applaud the initiatives, there is substantial skepticism about their long-term effectiveness.

Polls indicate that those who are aware of the latest policies tend to view Biden more favorably. Particularly among younger voters deeply affected by student debt, improved biden speech today messaging seems to resonate, creating a bridge between policy impacts and public approval. The optimists see a path toward relief, while others remain anxious over the sustainability of these reforms.

Solutions and Recommendations Moving Forward

As the Biden administration tackles the challenges surrounding student loans, here’s how borrowers can stay informed and proactive:

The ongoing evolution of joe biden student loans is not merely about policy changes; it reflects broader economic trends and the pressing need for accessibility in education. Staying informed empowers borrowers to navigate these opportunities and advocate for reforms that ensure education remains within everyone’s grasp. If you want to look at successful artists and their journeys, you might be interested in checking out Kane Brown‘s rise to fame or the exceptional talent showcased on Charli Xcx Merch; these stories inspire many navigating their paths through challenges.

Adaptability and ongoing advocacy will help shape a student loan system that truly serves the American populace, paving the way for future generations.

Joe Biden Student Loans: Fun Trivia and Interesting Facts

The Big Picture of Student Loans

Did you know that nearly 43 million Americans hold federal student loans? With the recent changes to Joe Biden’s student loans policies, it’s a crucial time for borrowers to stay informed. Speaking of changes, have you ever heard of the Zendaya robot suit? Yep, it’s a thing! While it’s got nothing to do with student loans, it just goes to show how innovation can surprise us. Just like the shifts in loan policies can impact the financial futures of so many individuals and families.

Who’s Affected by These Changes?

The Biden administration’s adjustments are geared towards providing relief for borrowers, especially those with lower incomes. This could mean significant savings, which is great news! But let’s pivot a bit. If you’re curious about mountain adventures, take a trip to Silverton, CO; it’s a hidden gem for outdoor lovers! Imagine using some of those potential savings on a trip to recharge and enjoy nature after years of loan stress.

Keeping Up with Student Loans

Now, back to the topic at hand. The excitement around Joe Biden student loans isn’t just about the loans themselves; it’s also about how the latest measures can lead to longer discussions about tackling debt. For instance, have you ever read about the “Blue Is the Warmest Color” sex scenes? Those moments have sparked conversations similar to how student loan discussions have ignited debates on educational access and equity. It’s all about tackling issues that affect our lives, whether it’s seen on a screen or lived through a financial journey.

Looking Ahead

As we look forward, the changing landscape of student loans is just one part of a larger picture. The recent House vote on social security benefits reflects the ongoing conversation about financial security in America. And while we’re all navigating these waters, don’t forget the joy of small victories too. Like those quaint spots in Palos Verdes where you can unwind after a hectic week of figuring out your finances. Balancing student loans with life’s pleasures is key, giving you something to look forward to amid all the paperwork.

In a nutshell, Joe Biden’s tweaks on student loans might just be the breath of fresh air many have been waiting for. Stay alert, keep knowledgeable, and who knows? Those loans could pave the way for a brighter future after all!